Best AI Bookkeeping Software for Realtors

Stop letting the IRS take a bigger commission than you do.

Built for US-based realtors and real-estate agents to protect every dollar of every closing with automated tax-shielding and instant deduction tracking.

- $5M+ in Tax Deductions

- 7,500+ hours saved

#1 Bookkeeping Software for Realtors and Real Estate Agents!

Why Realtors Choose Tabby for Bookkeeping and Taxes

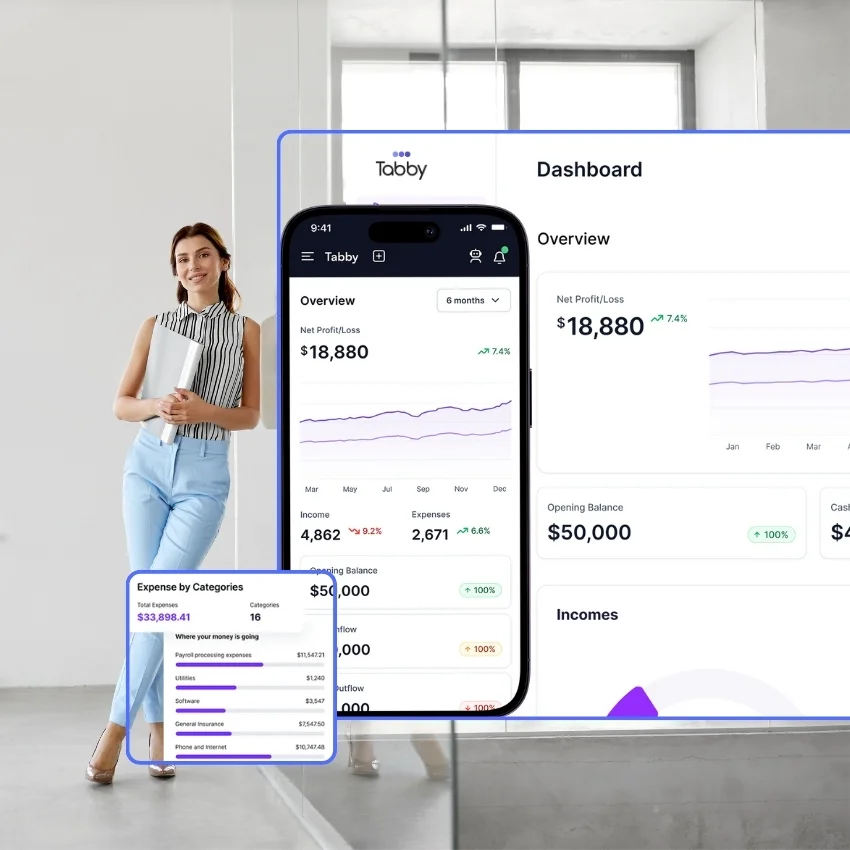

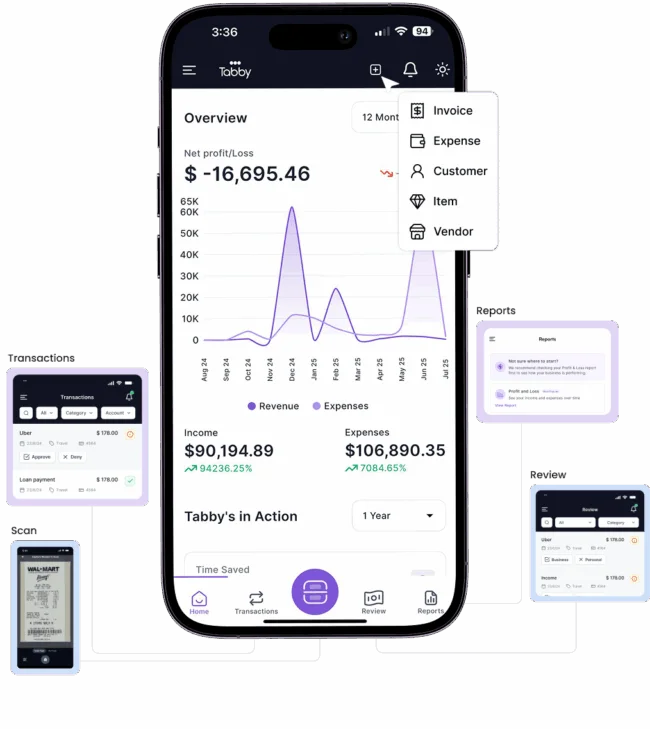

Manual accounting is a major pain for realtors. Tabby is the AI-powered accounting software that fixes it by automatically tracking income, categorizing expenses, and finding deductions to keep your finances organized.

Track Expenses and Find More Tax Deductions

As a real-estate agent expense tracker, Tabby automatically identifies deductible expenses like marketing, MLS fees, and brokerage costs which helps realtors maximize legitimate tax deductions without manual work.

Designed for Commission-Based Income

Tabby is designed specifically for realtor bookkeeping, not generic small businesses. It understands commissions, irregular cash flow, and the real expenses that come with being a 1099 real estate agent.

Tax-Ready Reports for Real Estate Agents

Generate clear, tax-ready reports in seconds. Tabby gives you real-time financial visibility, making it easier to plan quarterly payments and stay prepared during tax season. It’s accounting software for realtors that keeps your books organized year-round.

AI Bookkeeping for Realtors

Tabby’s AI automatically categorizes transactions and keeps everything organized in the background. No manual tagging, no accounting knowledge required, just bookkeeping for realtors that actually fits how you work.

Save 10+ Hours Every Month

Juggling showings, client calls, and closings leaves little time for bookkeeping. Tabby handles income, expenses, and taxes automatically so you can focus on closing more deals—not cleaning up spreadsheets.

Accurate, Automated Bookkeeping

TabbyAI cleans messy bank statement data, analyzes and categorizes your transactions in real-time, saving you hours of manual work.

- Smart categorization for real estate expenses

- Learns from your activity to improve accuracy

- Human-level precision without bookkeeping hassle

Save Up to $5,000 in Taxes

Tabby’s AI deduction finder identifies real-estate agent tax deductions hidden in everyday expenses. So you don’t leave money on the table.

- Detects eligible write-offs automatically

- Prepares expenses for tax season year-round

- Maximizes savings with zero extra effort

Track Every Dollar with Confidence

Monitor commissions, marketing costs, mileage, and business expenses in one place with automated expense tracking designed for commission-based work.

- Real-time expense tracking

- Smart categorization across accounts

- Clear visibility into your cash flow

Error-Free Transaction Matching

Tabby automatically matches bank transactions with the correct categories, reducing accounting errors and saving hours each month.

- Instant and accurate matches

- Fewer mistakes, cleaner books

- Less manual work, more time for clients

Let AI Handle Your DIY Bookkeeping

Tabby Accounting AI is built for solo realtors and independent real estate agents who are tired of managing DIY bookkeeping. Instead of spreadsheets and manual tracking, Tabby provides a simple, AI-powered bookkeeping and accounting solution designed to seamlessly integrate into your everyday real estate business, eliminating added complexity.

Advanced AI & Machine Learning

Tabby uses advanced AI and machine learning to automatically categorize transactions, detect spending patterns, and optimize real estate tax deductions. As you use the platform, the system continuously improves accuracy, helping you maintain clean, tax-ready books while saving hours each month on manual accounting work.

Mobile-First Convenience

Built for real estate agents on the move, Tabby lets you track income, scan receipts, and manage expenses directly from your phone. Whether you are between showings or closing deals, your real estate bookkeeping stays up to date in real- time.

Secure Bank Connections

Solo realtors, independent real-estate agents, and other self-employed professionals trust Tabby to simplify bookkeeping and tax preparation. After switching to AI-powered financial automation, many real estate professionals spend less time on accounting tasks and more time growing their business.

Trusted by Real Estate Professionals

Your Books, Always with You

Tabby’s mobile app is built for independent professionals who are constantly on the move—from open houses to client meetings.

- Capture receipts instantly for tax deductions

- Generate accounting reports with a tap

- Get real-time updates with smart notifications

Start for Free. Upgrade as Your Real Estate Business Grows

Tabby is actively used by independent real estate agents managing commissions, expenses, and tax prep without a full-time accountant. Start with the Free plan, keep your books organized, and upgrade only when your business needs more automation.

FREE FOREVER

Perfect for getting started

- ✓ Up to $15k Annual Expenses

- ✓ Single User

- ✓ Connect 1 Accounts

- ✓ Daily Account Sync

- ✓ P&L Report

- ✓ Basic AI Bookkeeping

- ✓ Email Support

STANDARD

For growing businesses

- ✓ Up to $200k Annual Expenses

- ✓ Single User

- ✓ Connect 3 Accounts

- ✓ Daily Account Sync

- ✓ P&L and Tax Ready Report

- ✓ Basic AI Bookkeeping

- ✓ Standard Email and Chat Support

PROFESSIONAL

For established businesses

- ✓ Unlimited Annual Expenses

- ✓ Up to 5 Users

- ✓ Connect Unlimited Accounts

- ✓ Real-time Account Sync

- ✓ Advance AI Categorization

- ✓ Advance AI Bookkeeping

- ✓ Advance Financial Reports

- ✓ Priority Chat and Email Support

14-day free trial

All paid plans include 14-days free trial period.

Cancel anytime

Cancel your plan before trial ends

Secured

Your data is secured by 256-bit encryption

Support

All plans include standard support.

Tabby vs Quickbooks

QuickBooks was built for accountants. Tabby is built for realtors and real estate agents. AI-powered, mobile-first, and designed to save small business owners time and money.

| Features | Tabby | QuickBooks |

|---|---|---|

| AI-Powered Transaction Categorization | ||

| AI Expense Pattern Learning | ||

| Built-in AI Tax Write-Off Finder | ||

| Smart AI Transaction Matching | ||

| Mixed Personal & Business Accounts | ||

| AI Categorization Assistant | ||

| Automated GL Based Bookkeeping | ||

| Real-Time Client Dashboard | ||

| Unlimited Bank Connections | Paid Plans | |

| Bank Connection with Magic Link | ||

| Receipt Upload & Matching | ||

| Invoice Creation | ||

| Automatic Bank Sync | ||

| Real-Time Profit & Loss Report | ||

| Bank-Level Encryption | ||

| Mobile-First Design | Partial | |

| Made for Small Businesses (CPA Input) | ||

| Tax-Ready Reports (One Tap Export) | ||

| Clean, User-Friendly Interface | ||

| Built for Non-Accountants | ||

| Affordable Pricing (Under $20/mo) | ||

| Chat & Email Support | Limited |

Frequently asked questions

Here is the most commonly asked questions about Tabby.

Are realtor fees tax deductible?

Yes. Many expenses related to running your real estate business are tax deductible. Common deductible realtor expenses include MLS fees, license renewals, advertising, professional dues, software subscriptions, and office-related costs. Proper bookkeeping helps ensure these deductions are tracked accurately. Tabby automatically categorizes expenses so you don’t miss eligible write-offs.

How much do realtors pay in taxes?

Most realtors are self-employed and typically pay both income tax and self-employment tax, which is around 15.3% on net earnings. The exact amount depends on your income, state taxes, and available deductions. Using bookkeeping software designed for realtors can help lower taxable income by keeping expenses organized and tax-ready throughout the year.

Can I use Tabby for both personal and business accounts?

Yes. Tabby allows you to securely connect multiple bank accounts and credit cards, including both personal and business accounts. Transactions are automatically categorized, giving realtors a clear view of business finances while keeping personal spending separate for accurate bookkeeping and tax reporting.

Are realtor fees tax deductible when selling your own home?

If you’re selling your personal residence, realtor fees are not deductible as a business expense. However, they can reduce your capital gains by being subtracted from the home’s selling price. For realtors selling properties on behalf of clients, business-related expenses remain deductible.

Can Tabby import past transactions?

Yes. Tabby can import up to 18 months of past transactions, depending on your bank. If full history isn’t available, you can upload bank statements manually. This helps realtors get their bookkeeping up to date quickly without starting from scratch.

Do realtors receive a 1099?

Yes. Most real estate agents work as independent contractors and receive a 1099-NEC instead of a W-2. You’ll report your income and expenses on Schedule C (Form 1040), pay self-employment taxes using Schedule SE, and make quarterly estimated tax payments. Tabby prepares tax-ready reports so filing is easier or seamless when working with a CPA.

Is Tabby built specifically for real estate agents?

Yes. Tabby is designed for solo realtors and independent real estate agents who need simple, AI-powered bookkeeping and tax-ready financial reports. It’s built to handle commissions, deductions, and 1099 income without the complexity of traditional accounting software.

Free Resources for Realtor Bookkeeping

Feel free to check our free resources developed and reviewed by experienced CPA, Accountants and Business experts.

You’re a Realtor. Not a Bookkeeper.

Let AI handle your books so you can focus on closing deals and living your life.