Get Your 2025 Books Organized FREE!

Sign Up Now

→

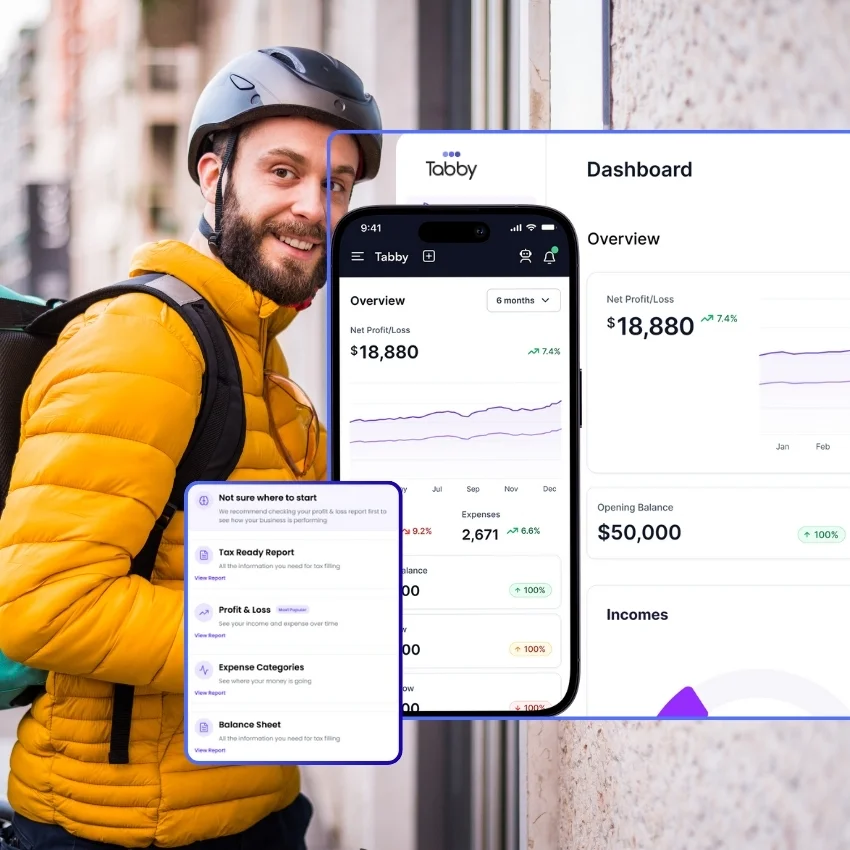

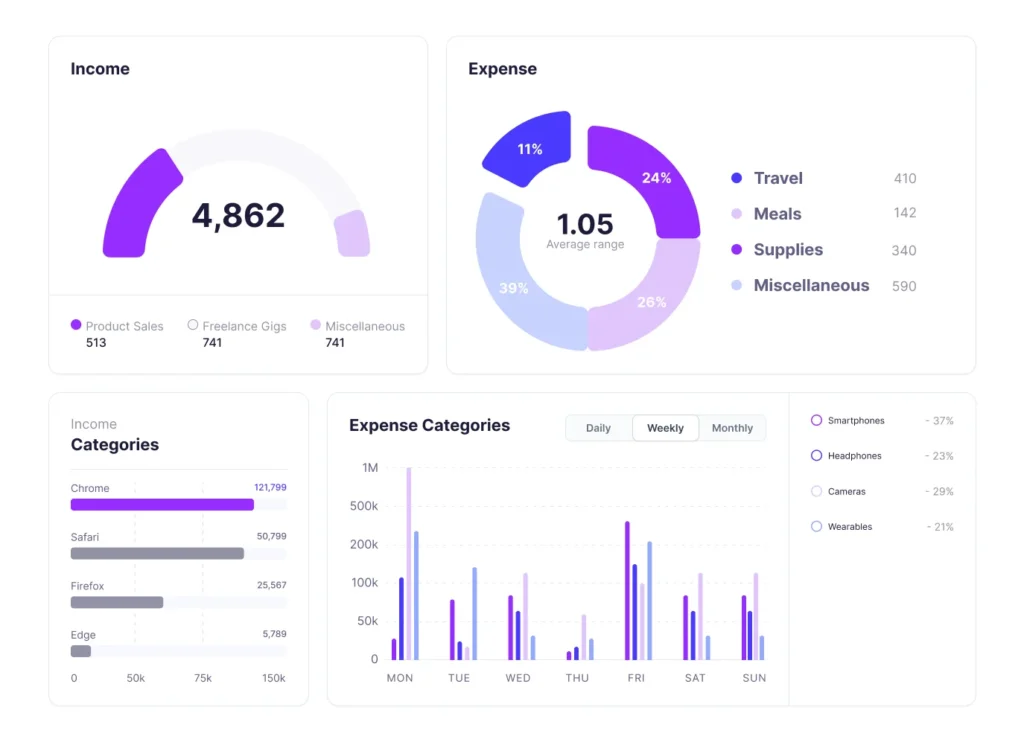

Stop wasting hours on spreadsheets- Tabby’s AI tracks every dollar, finds hidden savings, and keeps your books tax-ready while you focus on closing deals.

Uncovers overlooked financial gaps so you can plug leaks and keep more of what you earn

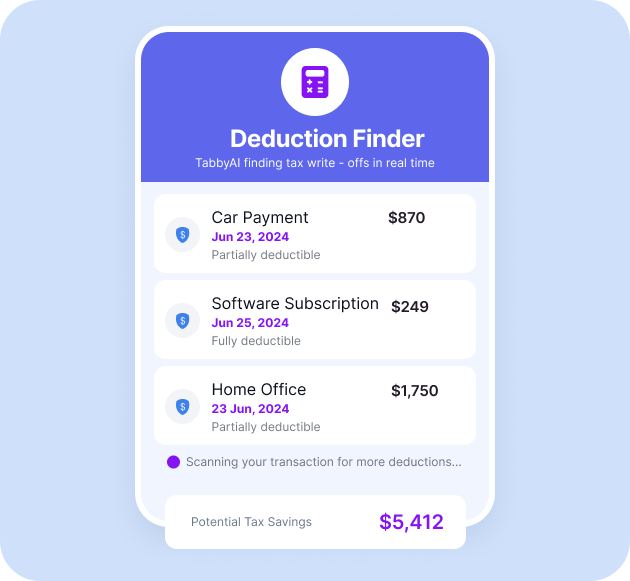

Automatically identifies deductible expenses to maximize your savings come tax season.

Get instant, easy-to-read financial snapshots to guide smart business decisions

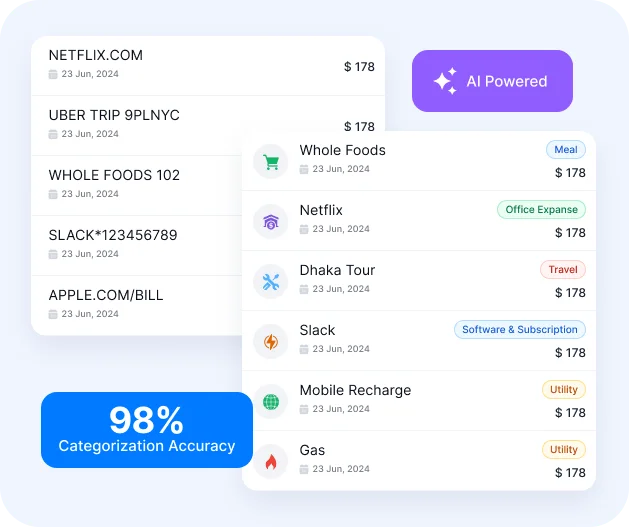

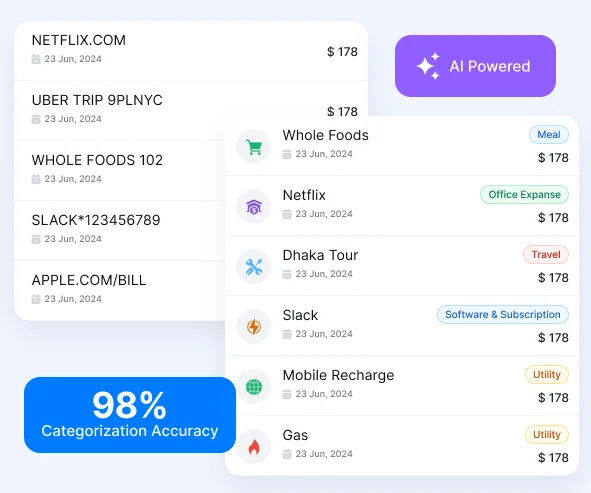

AI sorts transactions into the right categories instantly- no manual tagging required.

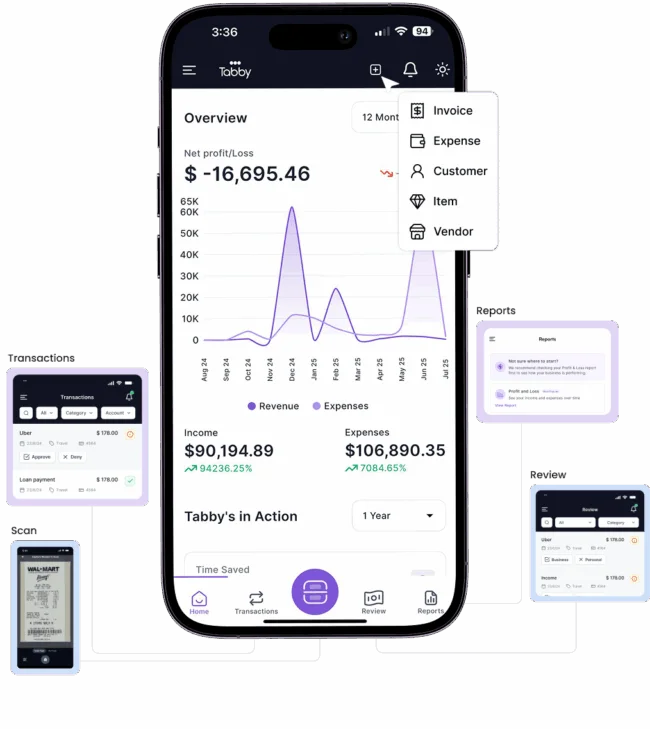

Tabby syncs with your bank and credit cards to automatically track and categorize your gig-related income and expenses in real-time.

Our AI-powered deduction finder surfaces write-offs you might miss — helping you save thousands each year in overlooked expenses like mileage, client meals, and marketing costs.

Get clean, downloadable reports that help you understand your earnings, deductible expenses, and prepare for quarterly or annual taxes with ease.

Snap a photo of your receipts and Tabby instantly extracts key details like date, vendor, and amount — no manual entry required.

Whether you’re driving, delivering, freelancing, or juggling multiple side gigs — Tabby automates your bookkeeping, keeps you organized, and helps you stay tax-ready without the stress.

Track income, scan receipts, and manage expenses on the go—right from your phone.

Connect your bank and credit cards securely to sync all transactions in real-time.

Tabby’s mobile app is designed for real estate agents who are always on the move. From open houses to client meetings, you can track expenses, scan receipts, send invoices, and monitor your cash flow — right from your phone.

Perfect for getting started

For growing businesses

For established businesses

All paid plans include 14-days free trial period.

Cancel your plan before trial ends

Your data is secured by 256-bit encryption

All plans include standard support.

QuickBooks was built for accountants. Tabby is built for you. AI-powered, mobile-first, and designed to save small business owners time and money.

| Features | Tabby | QuickBooks |

|---|---|---|

| AI-Powered Transaction Categorization | ||

| AI Expense Pattern Learning | ||

| Built-in AI Tax Write-Off Finder | ||

| Smart AI Transaction Matching | ||

| Mixed Personal & Business Accounts | ||

| AI Categorization Assistant | ||

| Automated GL Based Bookkeeping | ||

| Real-Time Client Dashboard | ||

| Unlimited Bank Connections | Paid Plans | |

| Bank Connection with Magic Link | ||

| Receipt Upload & Matching | ||

| Invoice Creation | ||

| Automatic Bank Sync | ||

| Real-Time Profit & Loss Report | ||

| Bank-Level Encryption | ||

| Mobile-First Design | Partial | |

| Made for Small Businesses (CPA Input) | ||

| Tax-Ready Reports (One Tap Export) | ||

| Clean, User-Friendly Interface | ||

| Built for Non-Accountants | ||

| Affordable Pricing (Under $20/mo) | ||

| Chat & Email Support | Limited |

Here is the most commonly asked questions about Tabby.

You can sign up, connect your accounts, and start seeing organized financial data in under 5 minutes.