AI Bookkeeping Software for Small Businesses

Run your business, not your books.

- $5,000+ in Tax Savings

- 10+ Hours Saved

Built by a CPA, to Power Your Finances

Tabby is designed by Ahad Ali, a seasoned CPA with over 12 years of experience helping thousands of real estate professionals stay tax-ready and financially organized. His deep industry knowledge powers the smart automation behind Tabby, so you can trust your books are in good hands.

Let AI Handle Your DIY Bookkeeping & Save You Money

Stop wasting hours on spreadsheets- Tabby’s AI tracks every dollar, finds hidden savings, and keeps your books tax-ready while you focus on closing deals.

Finds Loopholes

Uncovers overlooked financial gaps so you can plug leaks and keep more of what you earn

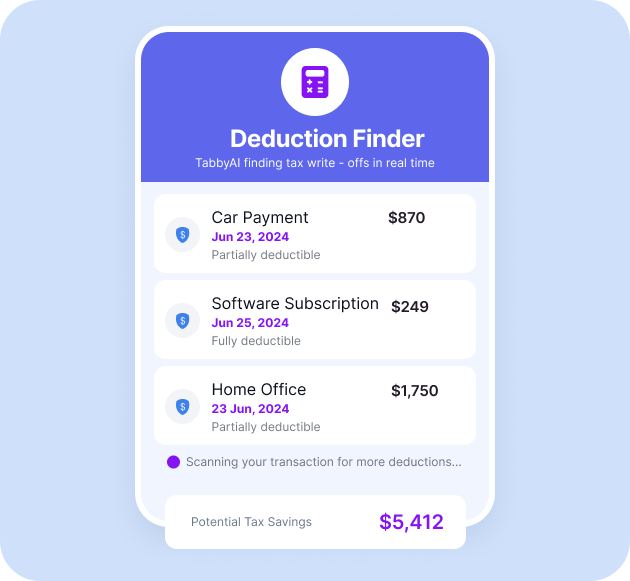

30% More Tax Deductions

Automatically identifies deductible expenses to maximize your savings come tax season.

Get Tax-Ready Reports in Seconds

Get instant, easy-to-read financial snapshots to guide smart business decisions

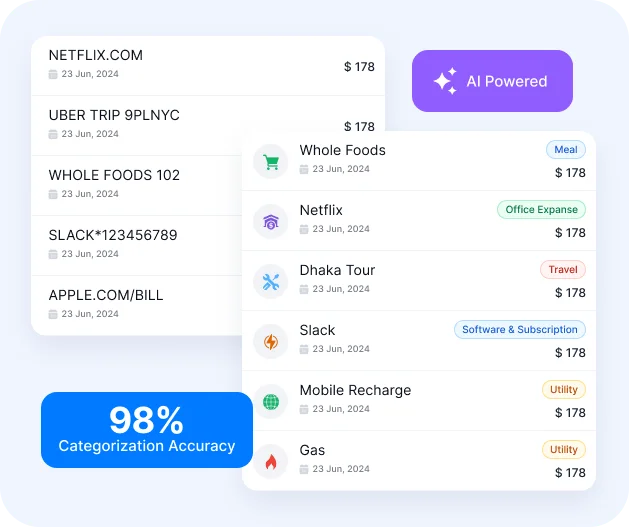

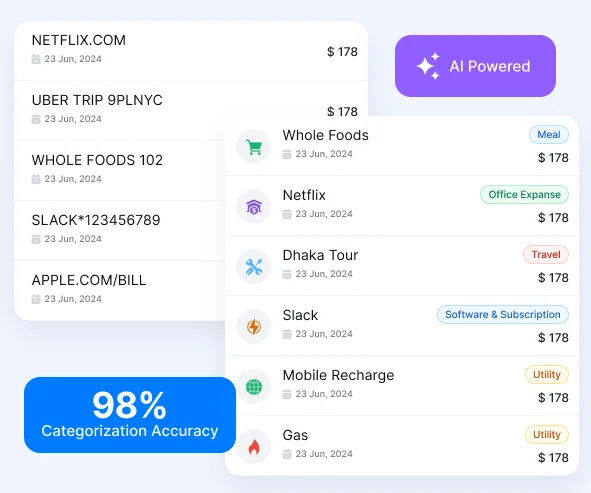

AI Categorization

AI sorts transactions into the right categories instantly- no manual tagging required.

Key Features Tailored for Small Business Owners

Save up to $5,000 in Yearly Taxes

- Detects eligible write-offs from everyday expenses

- Categorizes transactions automatically for tax time

- Maximizes savings with zero extra effort

95% Accurate Categorization

- Smart categorization

- Learns from every action

- Human level accuracy

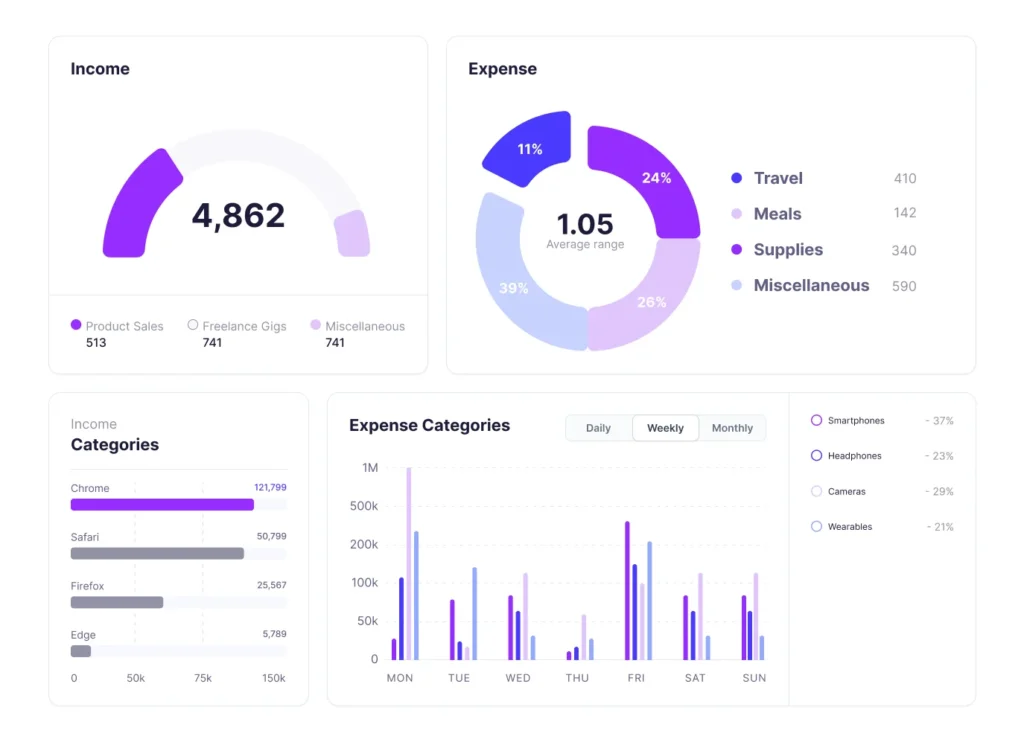

Track where your money is going

- Real-time Tracking

- Accurate Categorization

- Downloadable Reports

Instant Tax-ready Reports

- Automatically organized

- Maximized deductions

- Download anytime

Why Small Business Owners Love Tabby

Advanced AI & Machine Learning

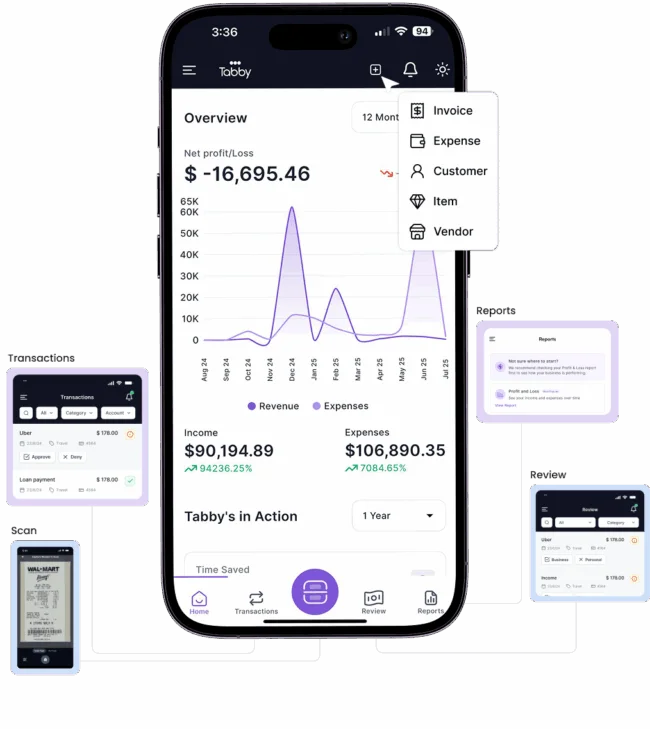

Mobile-First Convenience

Track income, scan receipts, and manage expenses on the go—right from your phone.

Secure Bank Connections

Connect your bank and credit cards securely to sync all transactions in real-time.

Trusted by Small Business Owners like You

Your Books, Always On the Go with You

Tabby’s mobile app is designed for real estate agents who are always on the move. From open houses to client meetings, you can track expenses, scan receipts, send invoices, and monitor your cash flow — right from your phone.

- Capture receipts instantly

- Generate reports with a tap

- Real-time updates & push notifications

Get started for free, upgrade when you grow

FREE FOREVER

Perfect for getting started

- ✓Up to $15k Annual Expenses

- ✓Single User

- ✓Connect 1 Accounts

- ✓Daily Account Sync

- ✓P&L Report

- ✓Basic AI Bookkeeping

- ✓Email Support

STANDARD

For growing businesses

- ✓Up to $200k Annual Expenses

- ✓Single User

- ✓Connect 3 Accounts

- ✓Daily Account Sync

- ✓P&L and Tax Ready Report

- ✓Basic AI Bookkeeping

- ✓Standard Email and Chat Support

PROFESSIONAL

For established businesses

- ✓Unlimited Annual Expenses

- ✓Up to 5 Users

- ✓Connect Unlimited Accounts

- ✓Real-time Account Sync

- ✓Advance AI Categorization

- ✓Advance AI Bookkeeping

- ✓Advance Financial Reports

- ✓Priority Support

14-day free trial

All paid plans include 14-days free trial period.

Cancel anytime

Cancel your plan before trial ends

Secured

Your data is secured by 256-bit encryption

Support

All plans include standard support.

Reasons to Choose Tabby AI Bookkeeping Software

| Features | Tabby | QuickBooks | Xero | Wave |

|---|---|---|---|---|

| AI-Powered Transaction Categorization | ✔️ | ❌ | ❌ | ❌ |

| AI Expense Pattern Learning | ✔️ | ❌ | ❌ | ❌ |

| Built-in AI Tax Write-Off Finder | ✔️ | ❌ | ❌ | ❌ |

| Smart AI Transaction Matching | ✔️ | ❌ | ❌ | ❌ |

| Mixed Personal & Business Accounts | ✔️ | ❌ | ❌ | ❌ |

| Receipt Upload & Matching | ✔️ | ✔️ | ✔️ | Limited |

| Real-Time Dashboard | ✔️ | ✔️ | Partial | ❌ |

| Invoice Creation | ✔️ | ✔️ | ✔️ | ✔️ |

| Automatic Bank Sync | ✔️ | ✔️ | ✔️ | ✔️ |

| Real-Time Profit & Loss Report | ✔️ | ✔️ | ✔️ | Limited |

| Bank-Level Encryption | ✔️ | ✔️ | ✔️ | ✔️ |

| Mobile-First Design | ✔️ | Partial | ❌ | ❌ |

| Made for Small Businesses (CPA Input) | ✔️ | ❌ | ❌ | ❌ |

| Tax-Ready Reports (One Tap Export) | ✔️ | ❌ | ❌ | Limited |

| Clean, User-Friendly Interface | ✔️ | ❌ | ✔️ | Partial |

| Built for Non-Accountants | ✔️ | ❌ | Partial | Partial |

| Affordable Pricing (Under $20/mo) | ✔️ | ❌ | ❌ | ✔️ |

| Chat & Email Support | ✔️ | Limited | ✔️ | Limited |

Frequently asked questions

Here is the most commonly asked questions about Tabby.

How can Tabby help my small business save time on bookkeeping?

Is Tabby suitable for small businesses without an accountant?

Can I use Tabby for both personal and business accounts?

Most realtors are independent contractors and receive a 1099 form. You’ll need to:

Report your income and business expenses on Schedule C (Form 1040).

Pay self-employment taxes using Schedule SE.

Make quarterly estimated tax payments to avoid penalties.

Tabby prepares tax-ready reports so you can file confidently—or hand everything off to your CPA with zero stress.

Can Tabby pull in my past transactions if I sign up today?

Can I connect multiple bank accounts to Tabby?

Free Resources for Realtor Bookkeeping

Feel free to check our free resources developed and reviewed by experienced CPA, Accountants and Business experts.