- Financial Planning,

- Self-employed,

- Tax Preparation,

- | May 17, 2025

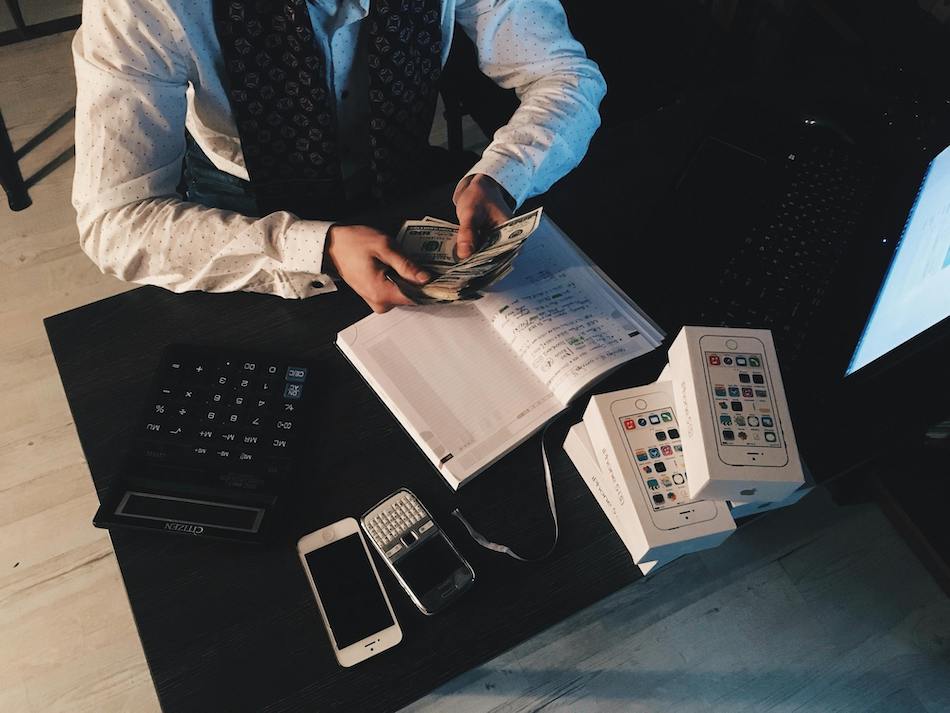

Self-Employed? Here’s How to Avoid Overpaying on Taxes

Being self-employed comes with many benefits—flexibility, independence and control over your work. However, it also means handling your own taxes, which can be overwhelming and cos...

- Self-employed,

- Tax Preparation,

- | March 26, 2025

How Freelancers Can Simplify Bookkeeping & Never Miss a Tax Deduction

Freelancers often juggle multiple projects, clients and invoices, leaving little time to focus on bookkeeping. However, staying on top of your finances is crucial. It helps to main...

- AI & Bookkeeping,

- Financial Planning,

- Self-employed,

- | March 26, 2025

Why Self-Employed Professionals Should Automate Their Bookkeeping

As a self-employed professional, you wear multiple hats—handling clients, managing projects and growing your business. But bookkeeping? That’s one task most freelancers and small b...

- AI & Bookkeeping,

- Financial Planning,

- Self-employed,

- Small Business,

- | March 26, 2025

Who Needs AI-Powered Bookkeeping? Top 10 Professions That Benefit Most

Keeping track of finances can be a challenge, especially for self-employed professionals and small business owners. Manual bookkeeping is time-consuming, error-prone, and often lea...