Why Self-Employed Professionals Should Automate Their Bookkeeping

As a self-employed professional, you wear multiple hats—handling clients, managing projects and growing your business. But bookkeeping? That’s one task most... Read more.

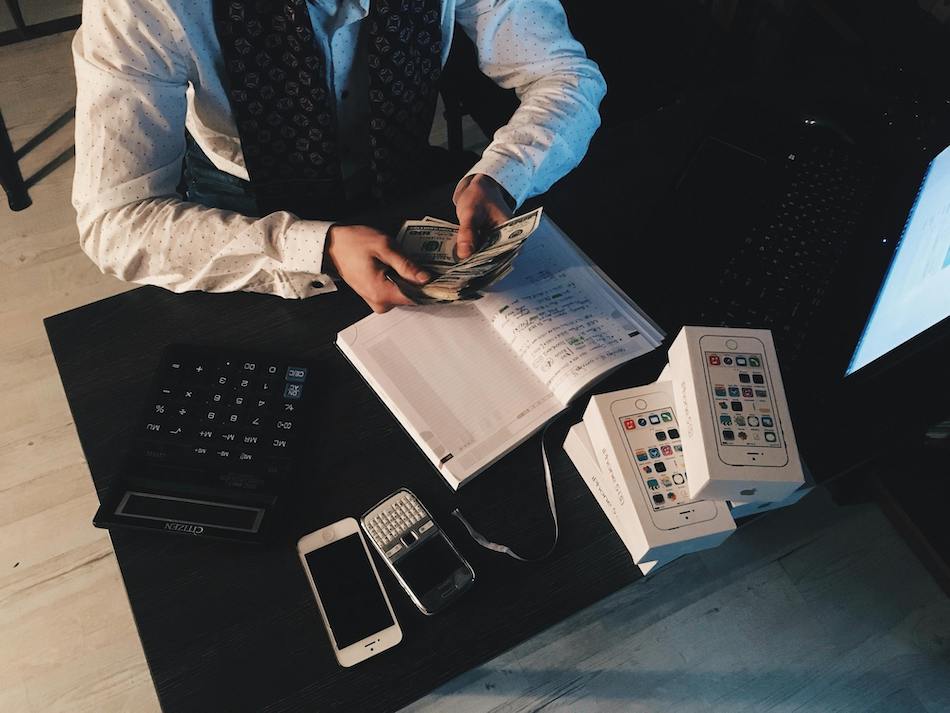

AI vs. Manual Bookkeeping: Which One Saves More Time & Money?

Bookkeeping is an essential task for any business, but it can be time-consuming and costly—especially for small business owners, freelancers and self-employed... Read more.

Who Needs AI-Powered Bookkeeping? Top 10 Professions That Benefit Most

Keeping track of finances can be a challenge, especially for self-employed professionals and small business owners. Manual bookkeeping is time-consuming, error-prone,... Read more.

Bookkeeping Mistakes You Shouldn’t Make (And How AI Fixes Them)

Bookkeeping is the backbone of any small business, yet many business owners struggle with keeping their financial records accurate. A single mistake—whether it’s... Read more.

A Bookkeeping Guide for 1099 Contractors: Track Income & Save on Taxes

If you’re a 1099 contractor, freelancer or gig worker- keeping track of your income and expenses is essential. It helps to stay tax-compliant and maximise... Read more.

How to Track Mileage & Business Travel Expenses Like a Pro

Tracking mileage and business travel expenses is essential for freelancers, small business owners and self-employed professionals. Accurate record-keeping ensures... Read more.

Best Accounting Practices for Airbnb Hosts & Short-Term Rental Owners

If you’re an Airbnb host or short-term rental owner, managing your income, expenses and taxes properly is crucial for maximizing profits and staying compliant... Read more.

What Business Structure is Best for Tax Savings?

Choosing the right business structure is one of the most important financial decisions a small business owner can make. The structure you select affects your taxes,... Read more.