- Financial Planning,

- Small Business,

- | May 9, 2025

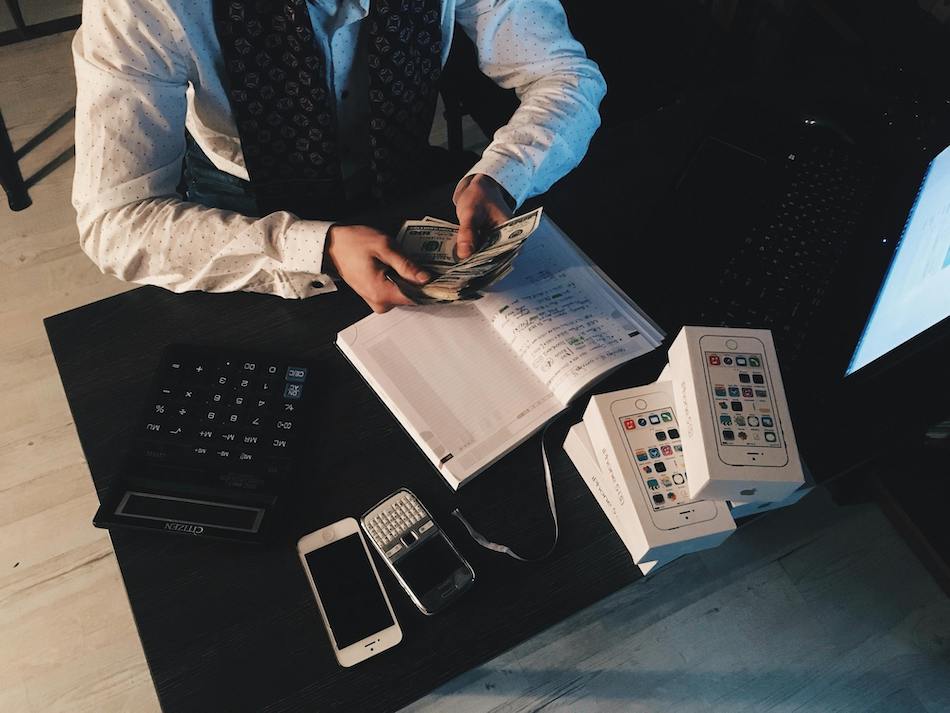

Top 10 Bookkeeping Mistakes Small Business Owners Make and How to Avoid Them

Bookkeeping is one of the most crucial aspects of running a small business. Yet, despite its importance, many business owners still struggle with it. Poor bookkeeping can lead to c...

- Financial Planning,

- Finance,

- Small Business,

- | May 8, 2025

Bookkeeping for Beginners: A Step-by-Step Guide for Small Business Owners

Bookkeeping might sound intimidating at first, but it’s one of the most important aspects of running a successful small business. Keeping your financial records in order helps you ...

- Financial Planning,

- | May 7, 2025

Why is Regular Bank Reconciliation Important?

Bank reconciliation might sound like accounting jargon, but it’s actually one of the most important tasks for keeping your business finances in check. In simple terms, it’s the pro...

- Financial Planning,

- Finance,

- | March 26, 2025

How to Keep Track of Business Expenses Without Losing Your Mind

Tracking business expenses is one of those tasks that can feel… endless. Receipts pile up, bank statements get messy, and sometimes you wonder, “Where did all my money go?” If [&he...

- Financial Planning,

- | March 26, 2025

Commonly Missed Business Write-Offs That Could Save You Thousands

Let’s be honest, tax season can feel like a storm cloud hovering over your head. Especially when you realize later that you could’ve saved hundreds (or even thousands) if only [&he...

- Financial Planning,

- Tax Preparation,

- | March 26, 2025

How to Track Business Expenses for Maximum Tax Savings

Let’s face it. Tracking expenses isn’t exactly the most exciting part of running a business. But here’s the thing, it’s one of the most important. Whether you’re an entrepreneur, f...

- Financial Planning,

- Finance,

- Small Business,

- | March 26, 2025

How to Separate Business & Personal Expenses to Avoid IRS Issues

I get it. You start a business, freelance gig, or side hustle and before you know it, you’re using the same card for groceries and client lunches. It seems harmless […]...

- Financial Planning,

- AI & Bookkeeping,

- Self Employed,

- | March 26, 2025

Why Self-Employed Professionals Should Automate Their Bookkeeping

If you’re self-employed, you already know the deal — one day you’re chasing invoices, the next you’re managing clients, and somewhere in between, you’re trying to actually do the w...

- Financial Planning,

- AI & Bookkeeping,

- Self Employed,

- Small Business,

- | March 26, 2025

Who Needs AI-Powered Bookkeeping? Top 10 Professions That Benefit Most

Let’s be real. Keeping your finances straight can feel like a full-time job — especially if you’re self-employed or running a small business. Manual bookkeeping? It’s a headache. I...

- Expense Tracking,

- Financial Planning,

- | March 26, 2025

How to Track Mileage & Business Travel Expenses Like a Pro

Tracking mileage and business travel expenses is essential for freelancers, small business owners and self-employed professionals. Accurate record-keeping ensures you maximize tax ...